Thailand is preparing a bold move to ease the financial strain on its people. In October 2025, the government will launch a 10 billion baht ($307 million) debt-buyback program aimed at purchasing bad household debt. The goal of the Thailand Debt-Buyback Stimulus program is to clean up household balance sheets, restore confidence, and spark new consumer spending to lift the slowing economy.

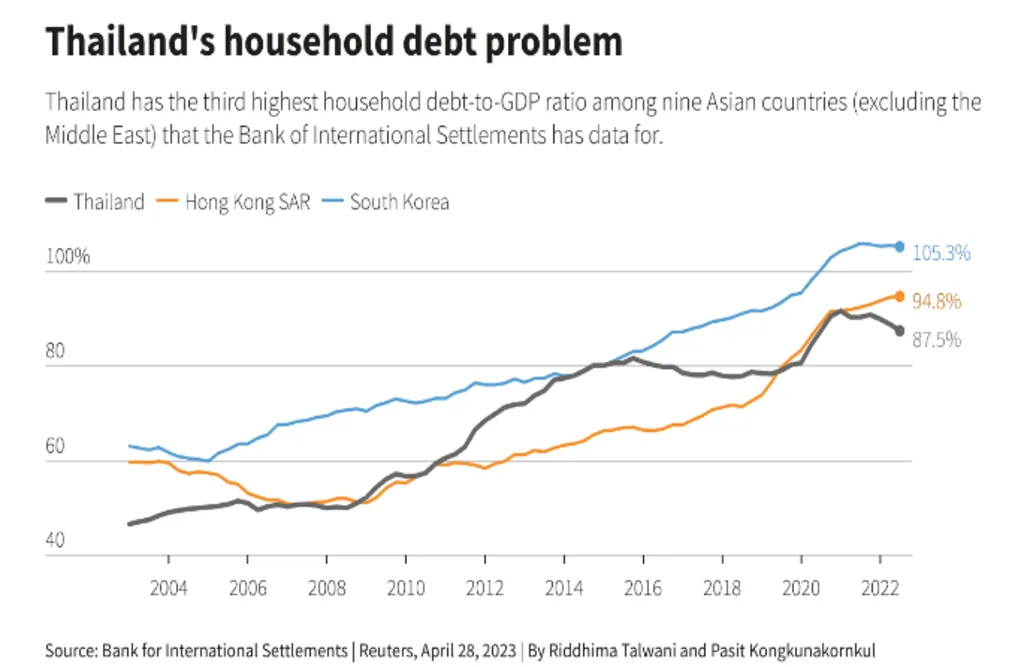

Thailand’s household debt problem is deep-rooted. The country’s household debt ratio stands between 86.8% and 91.3% of GDP, among the highest in Asia. With a total estimated household debt of 16.3 trillion baht, this level of debt has long held back growth and weakened consumer spending power. Many households struggle with overdue payments and mounting interest costs that leave little room for daily spending or saving.

Targeted Relief for Struggling Households

The Thailand Debt-Buyback Stimulus focuses on non-performing household debt, or simply loans that people can no longer pay back. By purchasing these bad debts, the government aims to reduce the pressure on families, allowing them to rebuild their financial stability. This effort, though modest compared to the total debt burden, represents a direct and targeted approach to support the most vulnerable households.

The buyback will be funded using remaining rehabilitation funds and contribution deductions, not from the government’s main fiscal budget. This means the policy provides relief without adding new debt to the state’s balance sheet, showing a sign of fiscal discipline in times when many governments are overspending. It also signals Thailand’s commitment to responsible stimulus — one that boosts confidence without creating new fiscal risks.

Thailand Debt-Buyback Stimulus to Boost Spending and Growth

Reducing household debt can have a powerful ripple effect. When families are no longer buried in overdue loans, they are more likely to spend on goods, services, and investments that fuel the economy. The Thai government sees this as a key step to reigniting consumer demand, which is essential for long-term recovery.

Read Also: Thailand E-commerce Surge Shows Trillion-Dollar Path

Following the announcement, the stock market reacted positively. Thai shares rose nearly 1%, a clear sign that investors welcome this policy. Market optimism suggests that the buyback could stabilize financial conditions and bring relief to struggling households. Economists also view this move as a way to improve credit quality and encourage responsible lending practices among financial institutions.

Read Also: Thailand Digital Wallet Stimulus: ฿10,000 Uptake and Impact

A Small Step Toward a Larger Recovery

While the ₿10B debt-buyback represents only a fraction of the nation’s 16.3 trillion baht total household debt, it carries symbolic and strategic weight. It shows the government’s determination to tackle debt head-on rather than rely solely on broad monetary policies. It also builds trust by showing that the government is aware of household realities — from high loan repayments to declining disposable income.

If the policy succeeds, it could serve as a model for future debt-relief efforts in Thailand and other economies facing similar challenges. For now, it’s a cautious but meaningful step that combines compassion with economic logic: relieve households, stimulate spending, and rebuild growth from the ground up.

Thailand Debt-Buyback Stimulus: Fiscal Responsibility with Compassion

The Thailand Debt-Buyback Stimulus highlights a balance between empathy and responsibility. By addressing the high household debt ratio without using new fiscal borrowing, Thailand shows that it’s possible to ease economic pressure while keeping discipline intact. As the program unfolds, it will test how quickly households can recover their confidence and contribute again to national growth. For organizations and investors looking to understand Thailand’s economic direction, or to explore advisory services on debt strategy and policy impact, Market Research Thailand offers global expertise and local insight to help navigate these changes.