The Thai government launched one of its most ambitious economic programs in 2024: a ฿500 billion digital wallet scheme. Framed as both an economic booster and a financial modernization tool, the initiative is designed to put ฿10,000 directly into the hands of eligible citizens. With nearly 70% of the population qualifying, the Thailand Digital Wallet Stimulus is reshaping spending behavior and accelerating the country’s move toward a digital economy.

Scale and Reach of the Scheme

The program targets citizens aged 16 and above with annual incomes below ฿840,000 and bank deposits under ฿500,000. This means roughly 50 million Thais became eligible in the first phase. The transfer is made through the Thang Rath app, a government-backed platform built to handle mass participation and encourage secure digital payments.

Later phases extend the program’s reach. The third phase alone targets 2.7 million youth aged 16-20, ensuring younger citizens adopt cashless transactions early. This design makes the scheme both a short-term stimulus and a long-term digital finance strategy.

Thailand Digital Wallet Stimulus to Boost Local Spending

Recipients cannot spend their digital wallet money freely anywhere; instead, the funds are restricted to local purchases in their registered municipalities. The idea is to strengthen neighborhood economies, support small businesses, and ensure the money circulates quickly within communities.

Government projections suggest the program could boost economic growth by at least 1.2%, a meaningful lift for a nation facing global trade slowdowns and domestic economic headwinds.

Digital Wallet Growth in Thailand

Thailand’s prepaid card and digital wallet market is already on an upward trajectory. By 2025, the sector is projected to hit USD 18.64 billion, expanding at an annual growth rate of 15.8%. The wallet scheme adds momentum by normalizing digital payments for millions of first-time users.

As e-commerce expands and government initiatives continue, the line between fiscal policy and financial innovation is becoming blurred. The wallet is not only a tool to stimulate consumption but also a step toward making Thailand a cashless society.

Thailand Digital Wallet Stimulus: Challenges and Delays

Despite its bold ambitions, the rollout has faced obstacles. In 2025, the government reallocated about ฿157 billion of planned disbursements to urgent areas like water management, tourism, transportation, and SME support. Political debates and economic challenges slowed the direct distribution of funds, limiting the immediate impact.

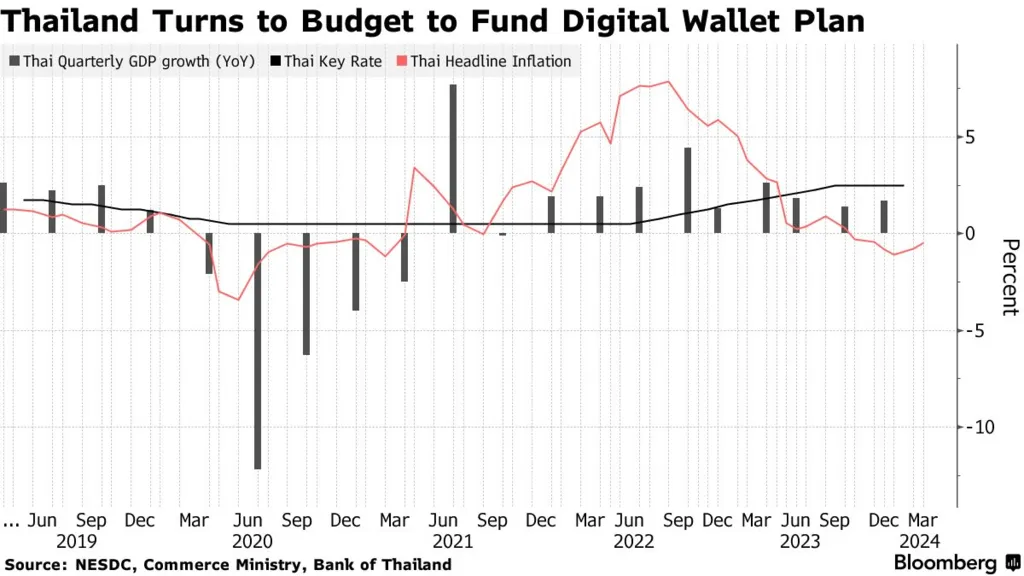

These delays come at a sensitive time. Thailand’s economy grew 2.6% in 2024 but is forecast to slow to 1.8% in 2025. The wallet was expected to soften that slowdown, but mixed execution has raised questions about whether the stimulus can deliver its full potential.

What Do The Citizens Think of Thailand Digital Wallet Stimulus?

For many Thais, especially lower-income households, the wallet provides welcome relief. It represents not just extra money but a government guarantee of support during uncertain times. Younger citizens, in particular, have embraced the app-driven model, which integrates seamlessly with existing mobile payment habits.

Still, some critics argue that the short-term consumption boost does little to address deeper structural issues, such as rising household debt and regional economic inequality. This tension between optimism and skepticism mirrors broader debates about stimulus-driven growth in developing economies.

Short-Term Impact and Long-Term Vision

The Thailand Digital Wallet Stimulus demonstrates how fiscal tools can serve multiple goals: immediate relief, local economic circulation, and digital adoption. While its short-term impact has been dampened by delays, the long-term benefits, such as building a tech-savvy population and encouraging digital transactions, may prove more transformative. If executed consistently, the wallet could be remembered less as a temporary cash injection and more as the turning point for Thailand’s cashless economy.