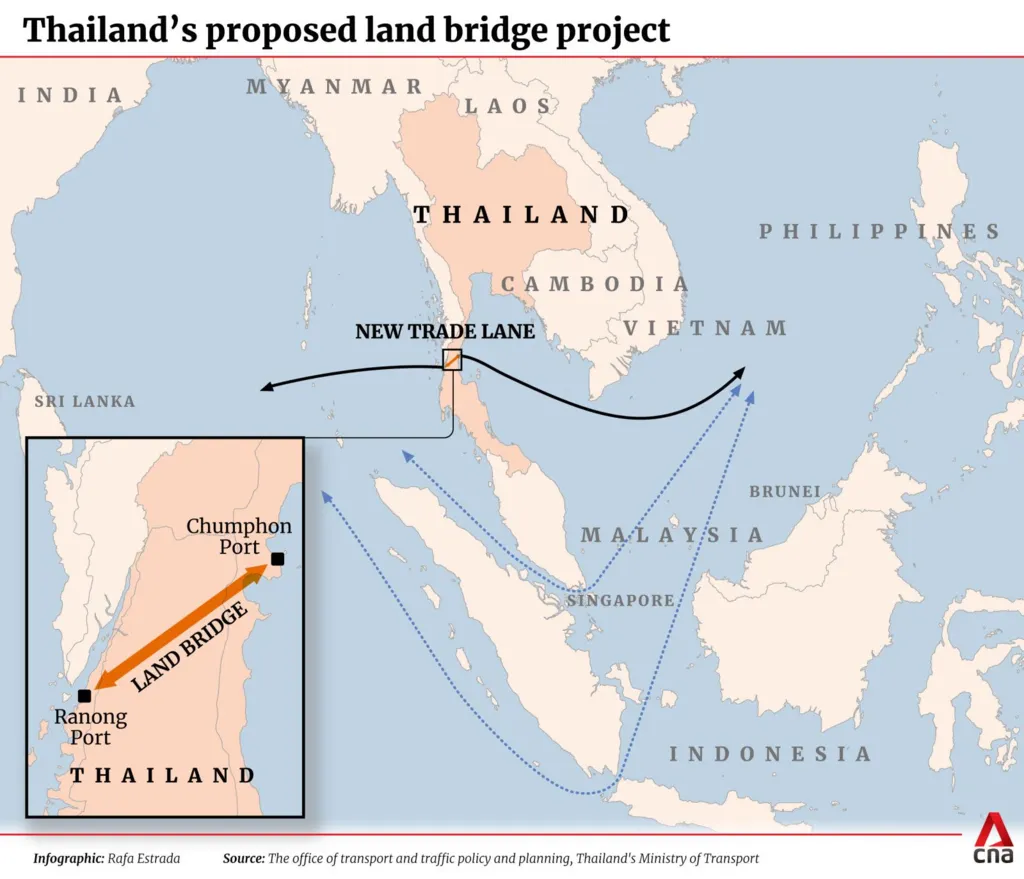

The Thai Landbridge project feasibility debate is gaining urgency as Thailand promotes a direct overland shipping route linking Chumphon and Ranong. The goal is simple but ambitious. Bypass the congested Malacca Strait and reduce shipping time between the Indian and Pacific Oceans by up to four days.

In 2026, Thailand plans to advance bidding after a renewed global roadshow. The message to investors is clear. This is a rare chance to reshape Southeast Asian logistics. Interest has surfaced from China and the Middle East, though final commitments remain uncertain.

Why the Malacca Strait Is the Benchmark for the Thai Landbridge Project Feasibility

The Malacca Strait currently handles around 40% of global trade. It is one of the busiest shipping corridors in the world. That scale creates risk. Congestion, geopolitical tension, and chokepoint exposure all raise costs for global trade.

Thailand’s Landbridge positions itself as an alternative. Instead of sailing through Singapore and Malaysia, cargo would unload on one coast, move across southern Thailand by road and rail, and reload on the other side. The promise is speed, resilience, and diversification.

Thai Landbridge Project Feasibility: The Economic Case

Feasibility studies show strong headline numbers. The project could create up to 280,000 jobs, with most benefits concentrated in southern Thailand. Regional GDP could rise by 1.4 trillion baht, while national GDP may grow by 1.5% through expanded exports and logistics activity.

Financial indicators are equally bold. The Economic Internal Rate of Return ranges from 14.77% to 17.38%. Net Present Value stands at 307.56 billion baht, with a benefit-cost ratio of 1.18. These figures support the argument that the project can deliver long-term economic value if executed well.

Roadshows and Investor Sentiment

At a major event in May 2024, more than 100 Thai and foreign companies expressed interest. Yet, caution remains. Large global shipping firms such as MSC and HMM have not committed. Their hesitation reflects the project’s scale and risk profile.

The revised investment value stands at 997.68 billion baht, with bidding targeted for 2026. China and Middle Eastern investors are watching closely. At the same time, Thai officials are careful to avoid dependence on a single funding source.

High Stakes in a Competitive Region

If funded, the Landbridge could rival the throughput of Hong Kong’s busiest port. That would redefine trade flows across Southeast Asia. But competition is intense. Malaysia’s East Coast Rail Link and Port Klang expansion offer rival routes and upgraded capacity.

The Landbridge’s advantage lies in diversification. It offers an alternative when Malacca becomes crowded or unstable. That strategic value may matter more than pure volume in the long run.

Read Also: Southern Charm Drives Thailand Border Tourism Revival, Boosting Cross-Border Ties

Final Verdict on Thai Landbridge Project Feasibility

The Thai Landbridge project feasibility rests on one question. Will investors back a controversial but transformational idea? The upside is huge. So are the risks. For investors and policymakers seeking deeper insight, Market Research Thailand by Eurogroup Consulting brings over 40 years of distinguished experience delivering strategic consulting services, with a strong focus on market research in Thailand and Southeast Asia. Our team provides clear analysis and local insight, making Eurogroup Consulting the essential partner for navigating this rapidly evolving logistics and infrastructure landscape.