Thailand is at an energy crossroads. In 2023, 84% of the country’s electricity still came from fossil fuels, mostly natural gas. Only 16% came from renewables, far below the global average of 39%. This heavy dependence on imported fossil fuels, or about 50% of Thailand’s energy, is costly and unsustainable, driving the government to develop Thailand Renewable Energy Policy.

The government is pushing ahead with the Alternative Energy Development Plan (AEDP) to address this. Its aim: increase renewable energy’s share to 30% of total final energy consumption by 2036. If implemented aggressively, that figure could rise to over 37%, according to the International Renewable Energy Agency (IRENA).

Why Thailand Renewable Energy Policy Matters: More Than Just Carbon

The shift to clean energy isn’t just about reducing emissions. If Thailand reaches the 37% renewable energy target by 2036, it could save $19 billion each year in reduced fossil fuel imports. That’s money that could be reinvested into local development.

At the same time, it’s projected that the switch could create 40,000 new jobs, mostly in solar, wind, and bioenergy sectors. The transition also offers major health and environmental upsides—cutting greenhouse gas emissions by 140 million tons and saving $8 billion annually in avoided pollution-related costs.

Read Also: Inside The Vital Thailand Renewable Energy Expansion Plans

Community Energy: Powering Rural Thailand

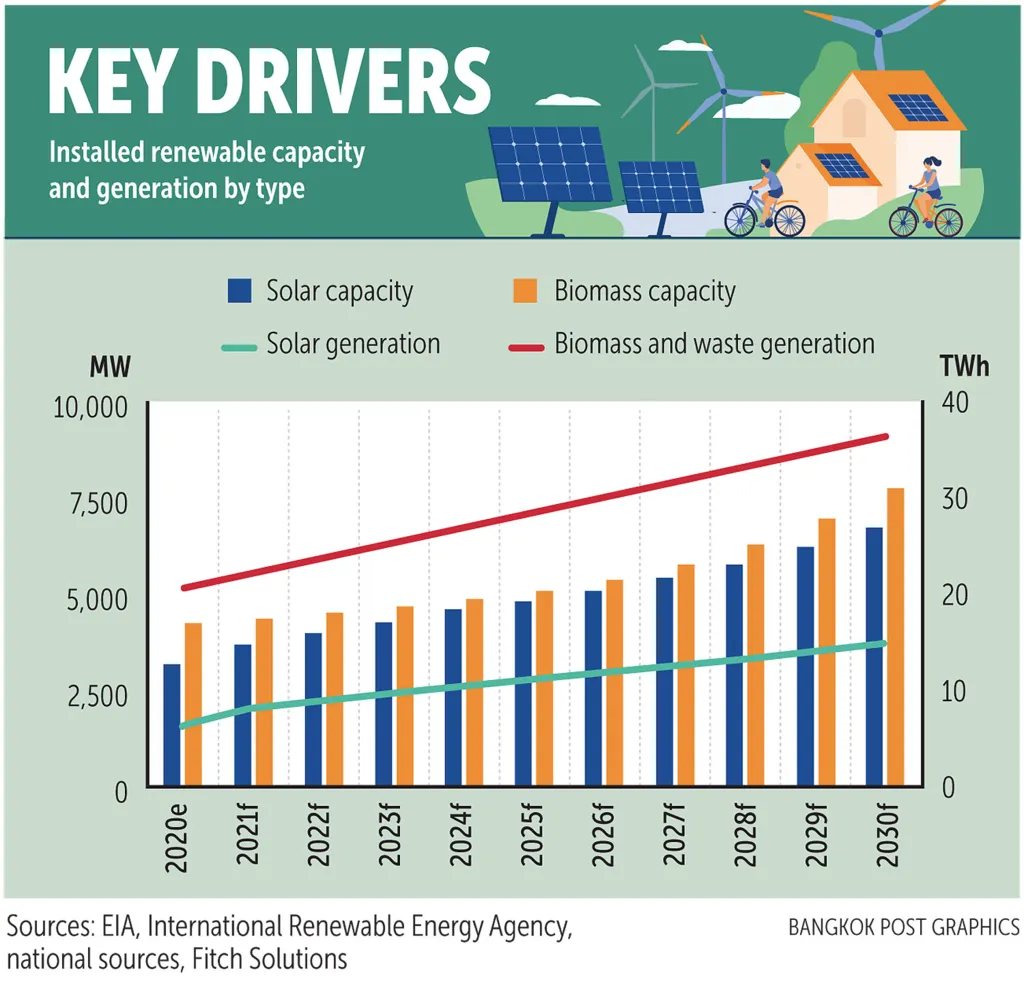

A key pillar of Thailand’s renewable energy push is decentralized community power projects, particularly in agriculture-dependent regions. The government’s "Bio-Circular-Green (BCG) Economy Model" incentivizes farmers to convert agricultural waste into biomass energy. The common waste used is rice husks, palm oil residues, and sugarcane bagasse.

Tools of the Thailand Renewable Energy Policy: Incentives and Infrastructure

To drive adoption, Thailand’s renewable energy policy uses several tools:

-

Feed-in tariffs (adders) to guarantee profitable prices for producers

-

Power purchase agreements (PPAs) to secure long-term contracts

-

Support for small and very small power producers, encouraging decentralized, community-level power generation

These measures are designed to attract private-sector investment while making the grid more resilient and flexible.

Read Also: Thailand Infrastructure Investment Surge Catalyzing Economic Growth

Sectoral Strategies: Solar, Wind, Biomass

The new draft Power Development Plan (PDP 2024) ups the ante: it targets 51% of total electricity generation capacity from renewables by 2037.

Here’s how Thailand plans to get there:

-

Solar: +2,632 MW

-

Wind: +1,000 MW

-

Biogas and Biomass: significant expansion for rural energy security

These sectors combined currently make up just 5% of Thailand’s energy mix, far behind regional leaders like Vietnam. But they’re now central to Thailand’s plan for cleaner, cheaper, and more secure power.

The Road Ahead for Thailand Renewable Energy Policy

Thailand’s energy demand is projected to rise by 78% by 2036. Meeting that growth with fossil fuels would deepen its reliance on imports and strain public health systems. Meeting it with renewables, on the other hand, could transform the country.

The Thailand renewable energy policy is about reshaping the economy, building domestic energy security, cutting harmful emissions, and obviously, generating power. If the country stays the course and adopts bolder measures, the 37% renewable share is not only possible—it’s practical. And with clear government targets, growing investor interest, and public health at stake, the time to act is now.