Thailand’s gold sector is pushing back strongly against a proposed tax on baht-denominated gold transactions. The Thailand Gold Tax Opposition serves as a warning that the measure could disrupt trade, weaken investor confidence, and damage Thailand’s standing as a regional gold hub. The debate over the proposal has intensified as the baht strengthens, creating tension between policymakers’ goals of stabilizing the currency and the industry’s need for open, competitive markets.

Thailand Gold Tax Opposition: The Baht’s Strength and Its Ripple Effects

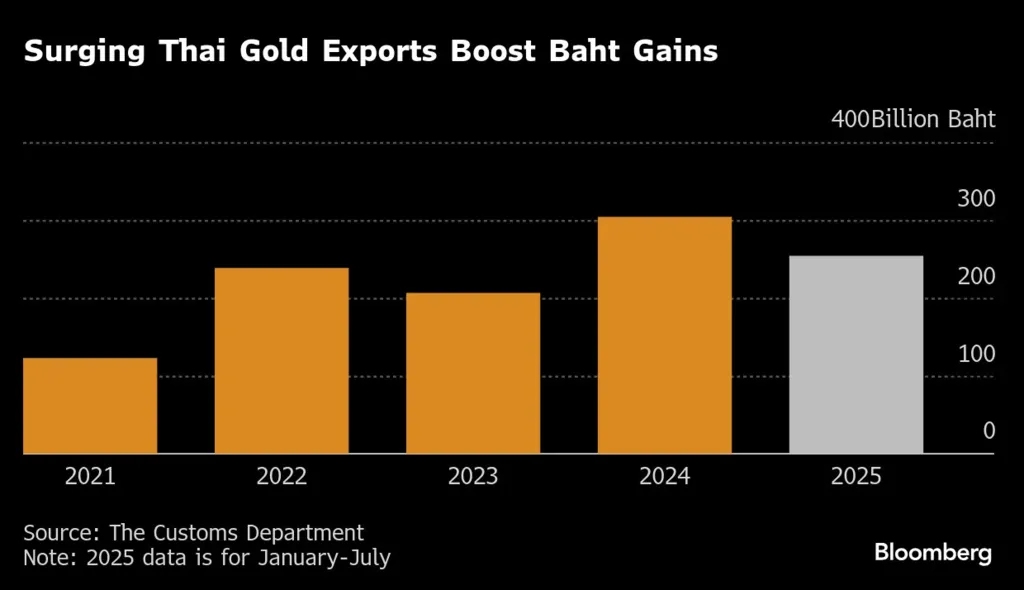

Thailand’s currency has surged approximately 7% in 2025, reaching its strongest level since 2021. This appreciation is driven partly by a 69% increase in gold exports, valued at around $8 billion, alongside a weakening US dollar. The baht’s rise is putting pressure on the country’s export and tourism sectors, which together account for about 70% of GDP.

For the government, this poses a challenge: a strong baht makes Thai exports more expensive and tourism less competitive, threatening recovery in these vital sectors. The proposed 1-2% tax on baht-denominated gold transactions is seen by some policymakers as a way to curb capital inflows and cool the currency’s rally.

Read Also: Thailand Digital Wallet Stimulus: ฿10,000 Uptake and Impact

Industry Alarm Over Market Disruption

The gold industry is firmly opposed. The Gold Traders Association argues that the tax could distort the market without effectively slowing the baht’s rise. Neighboring countries such as Malaysia, they note, are reducing gold taxes to attract trade and not imposing new ones.

Association president Jitti Tangsithpakdi warned, “If taxed, everything will be ruined.” He emphasized that Thailand risks losing its status as a regional gold trading hub if the measure proceeds.

Around 70% of gold trading in Thailand is conducted online through baht-denominated platforms. This means the proposed tax would directly impact the majority of retail and institutional traders. Industry experts caution that higher transaction costs could drive investors to offshore markets or shift trading into U.S. dollar-based channels, undermining Thailand’s domestic liquidity.

Economic Trade-Offs and Market Consequences

Quantitative models estimate that the Thailand Gold Tax Opposition could reduce capital inflows by 10-15%, potentially stabilizing the baht’s appreciation within a 3-5% annual range. However, this potential stabilization may come at the expense of market competitiveness and business activity.

Even though gold exports account for a small share of total exports, large shipments — such as those to Cambodia, valued at $2.35 billion in the first eight months of 2025 — play a key role in Thailand’s external trade balance. Curtailing these transactions could weaken overall export momentum, counteracting government efforts to boost trade.

Regulatory Voices Urge Caution

A Bank of Thailand official recently cautioned that the proposed Thailand Gold Tax Opposition measure may have unintended consequences. Instead of taxes, the central bank prefers market-driven approaches, such as encouraging gold transactions in U.S. dollars rather than baht.

This approach would reduce upward pressure on the local currency while keeping Thailand’s gold market attractive to investors. Economists also note that shifting toward dollar-based trading aligns with international practices and would help Thailand remain competitive in regional gold commerce.

Balancing Stability and Growth

The proposed tax highlights a broader policy dilemma: how to balance financial stability with market competitiveness. While stabilizing the baht is crucial for exporters, penalizing gold traders could deter foreign investors and reduce Thailand’s role in regional financial flows.

The gold industry insists that regulatory collaboration, not taxation, is the key. Strengthening monitoring systems and improving reporting mechanisms could help manage speculative inflows without driving legitimate business offshore.

Read Also: Thailand Generational Wealth Shift Gains Momentum, Sparking Family Offices

Thailand Gold Tax Opposition: Policy Crossroads Ahead

The debate around the proposed gold tax reflects growing Thailand Gold Tax Opposition from across the financial ecosystem. With the baht still strong and investor sentiment cautious, policymakers face the difficult task of maintaining currency stability without undermining sectoral confidence. For now, dialogue between regulators and the gold sector will determine whether Thailand can maintain its regional leadership while adapting to shifting macroeconomic realities. The final outcome will likely shape the country’s broader investment climate in the years ahead.