The Thai stock market has been through a turbulent stretch. After tumbling almost 50 points, or 3.9%, in just two days, the Stock Exchange of Thailand (SET) index finally broke its losing streak. The recovery comes after weeks of Thailand Stock Market Challenge and pressure from political uncertainty and foreign investor withdrawals that shook market confidence.

Foreign investors sold nearly 150 billion baht worth of Thai equities in 2024. The sell-off hit liquidity and dragged sentiment down across the board. Many investors continue to stay on the sidelines in 2025, waiting for clearer signals on stability and growth.

Thai Stock Market May Challenge 1,300-Point Mark

Thailand’s economy is expected to grow 2.7% in 2025, which is a modest pace weighed by higher borrowing costs and ongoing geopolitical tensions. Tight monetary policies and cautious business activity have made local markets sensitive to global economic shifts.

Yet, in recent sessions, signs of recovery have started to appear. The SET index bounced above the 1,285-point level, gaining over 15 points, or 1.2%, in consecutive trading days. This upturn has raised hopes that the market might challenge the 1,300-point psychological and technical barrier soon.

Analysts believe the SET could move within a range of 1,322 to 1,581 points in 2025. While the path remains uneven, the potential for a short-term rally is growing as investors begin to see sector-specific strength.

Sector Strength Fuels Thailand Stock Market Challenge Optimism

Four key sectors (food and agro-industry, finance, resources, and technology) have been driving the recent rebound. These industries have shown resilience amid global volatility, reflecting Thailand’s mixed economic base and its adaptability to shifting global demands.

Read Also: 44B Baht Thailand Co-Payment Program Boosts Economy

The food and beverage sector continues to perform well, supported by both domestic consumption and steady exports. The finance sector is benefiting from stable banking operations and improving asset quality. In the resource segment, rising energy and commodity prices have boosted revenues, while the technology sector gains from the growing digital transformation trend and global tech recovery.

Read Also: Thailand Water Crisis Risk: Economic Threats from Droughts and Floods

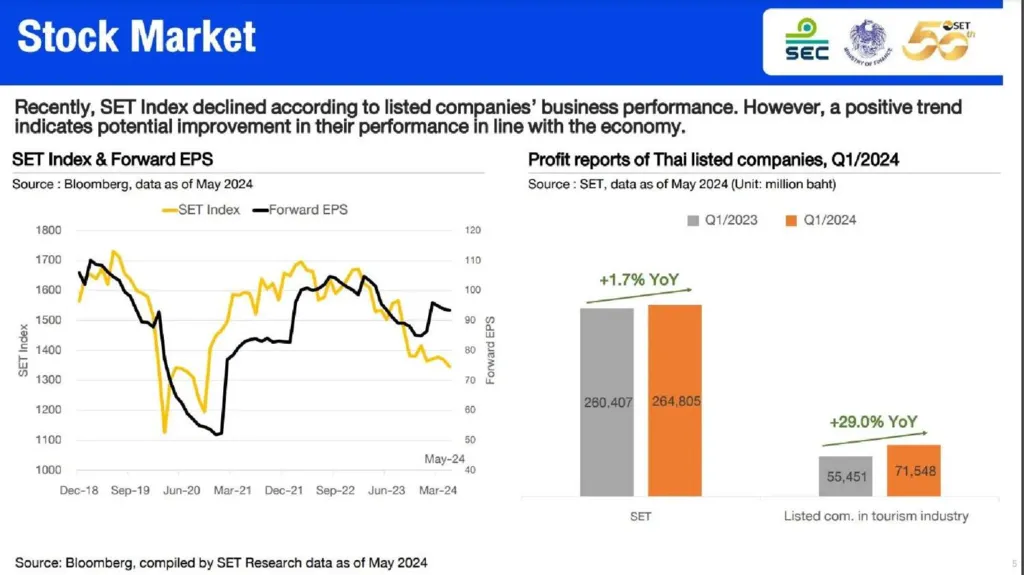

This sectoral strength is underpinned by an expected 22% year-over-year net profit growth for listed companies in 2025. Defensive industries like commerce and consumer goods are expected to help cushion risks from external uncertainties. Together, these factors are giving investors reasons to reconsider their cautious stance.

Global Shifts Add to Domestic Momentum

Thailand’s government investment programs and a resilient tourism recovery continue to lend support to the market. Tourism, one of the country’s biggest revenue drivers, has rebounded steadily, adding confidence to consumer spending and service sector growth.

At the same time, global economic shifts are opening new opportunities for export-oriented and tech-driven businesses. As foreign investors re-evaluate regional markets, Thailand could stand out as a value opportunity — especially if political conditions stabilize and earnings growth remains strong.

Thailand Stock Market Challenge Is Testing the 1,300 Barrier

For now, the Thailand Stock Market Challenge centers on whether the SET index can hold above its current levels and break through 1,300. A close above that mark could attract renewed buying and improve sentiment after months of volatility.

While external risks remain, from interest rate changes to global trade tensions, Thailand’s market fundamentals appear more solid than the recent declines suggest. The mix of steady economic growth, sector profits, and improved investor confidence could pave the way for a stronger finish in 2025.

If you want to explore more insights or strategies related to the Thailand Stock Market Challenge, contact Market Research Thailand. As a global consulting firm, Market Research Thailand helps businesses and investors navigate complex market conditions with clarity and precision.