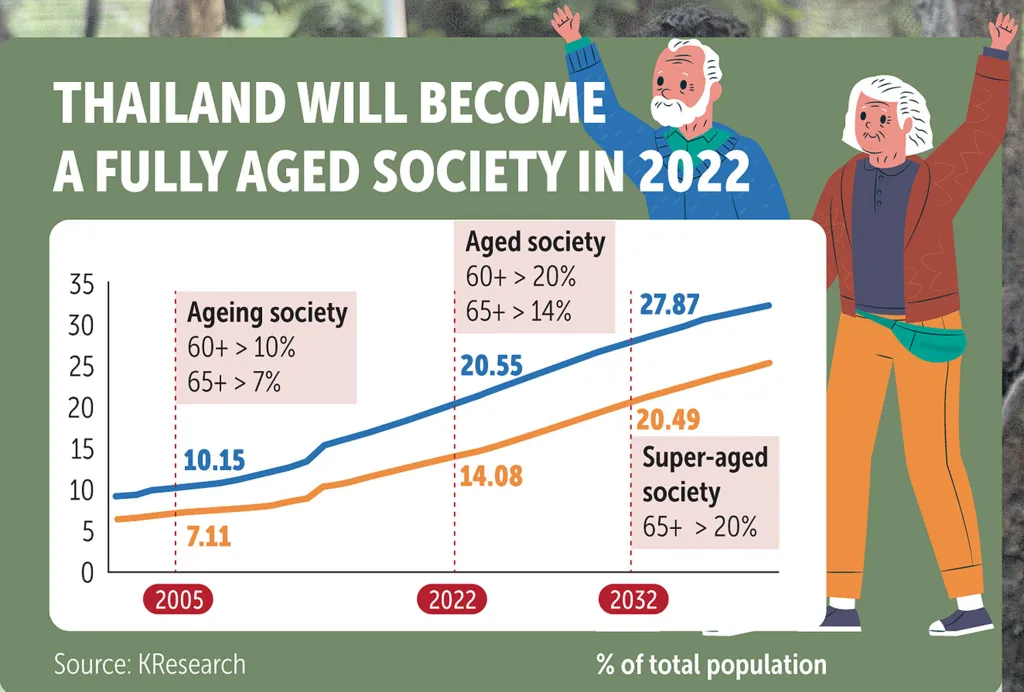

Thailand is aging fast. As of early 2024, 13.2 million people, or 20% of the population, are aged over 60. That share is expected to rise to 31% by 2040, making Thailand a "Super-Aged Society" in just a few years. Each year, Thailand adds nearly 900,000 new seniors, a number that is expected to hit 1 million annually by 2025. This rapid demographic shift is reshaping demand across healthcare, senior services, and lifestyle products, giving rise to the growing Thailand aging population market.

Over the last decade, the elderly population has grown by 4.8% every four years, driven by low birth rates and longer life expectancy. These changes are now unlocking major opportunities for businesses ready to adapt. Let's take a look!

Senior Care: A Booming Business Segment

The number of licensed elderly care businesses in Thailand has soared to 887, with 708 nursing homes across 55 provinces. Since 2018, the number of these facilities has increased by 25.1% annually, a clear sign of surging demand for both public and private senior care services.

This mirrors a wider trend. The Asia-Pacific elderly care market is the fastest-growing globally, while the global elderly care market is expected to nearly double from US$1.02 trillion in 2023 to $1.96 trillion by 2032.

For businesses in healthcare, real estate, and tech, this signals a golden opportunity. Demand is expanding for luxury retirement communities, in-home caregiving, remote health monitoring, and rehabilitation services tailored for elderly needs.

Read Also: Thailand’s Smart City Projects are Driving Urban Living

Healthcare Services and Products on the Rise for Thailand Aging Population Market

Though more than 95% of Thai seniors remain socially active, many require ongoing medical support. Chronic conditions such as diabetes, cardiovascular disease, dementia, and mobility issues are increasingly common.

This has pushed demand for chronic disease management programs, physical therapy services, and telehealth platforms that help seniors maintain their independence while accessing care.

Beyond healthcare, there’s a surge in demand for senior-friendly consumer products. These include ergonomic furniture, wearable health tech, and appliances designed for ease of use. As aging becomes a key lifestyle factor, brands that prioritize accessibility and design will gain market share.

Thailand Aging Population Market: The Workforce and Economy Must Adapt

Thailand’s aging shift affects more than just health—it changes how people live, work, and consume. As seniors live longer, they remain active participants in the economy. This creates demand for leisure services, financial planning, and insurance products tailored to older demographics.

It also places pressure on the country’s workforce. With fewer young workers entering the labor market, Thailand must invest in elder care training, geriatric healthcare education, and automation solutions to maintain productivity.

Read Also: Shortage in Skilled Labor in Thailand: Can Training Help?

Thailand Aging Population Market: Time to Act on the Aging Economy

Instead of a future trend, the Thailand aging population market is a present reality. With one in five Thais already over 60 and 1 million more seniors added each year, the shift is both large and fast-moving. Businesses that act now—by offering age-friendly products, healthcare innovations, and elder services—can lead in this expanding market. In an aging society seen globally, meeting senior needs is smart business.