Overview of Vehicle Production in Thailand

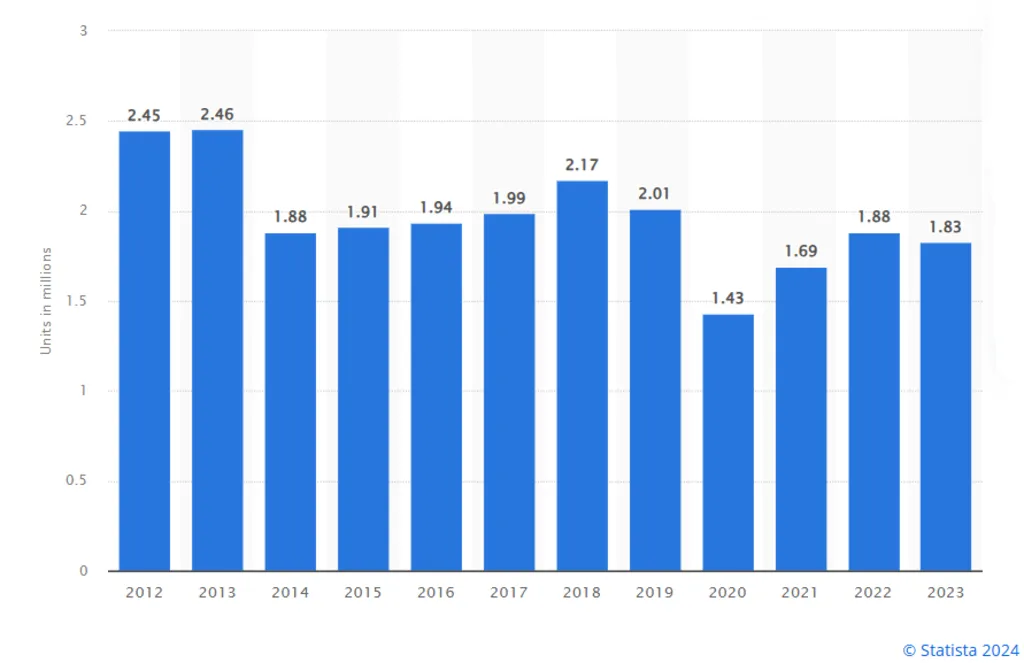

Thailand has solidified its position as one of Southeast Asia’s largest vehicle markets, with a notable production volume of approximately 1.83 million units in 2023. This achievement places Thailand ahead of its regional counterparts, Indonesia and Malaysia, making it the leading motor vehicle-producing country in the ASEAN region. In this article, we provide you insights from experts at Thailand Mobility Consulting to navigate the complexities and maximize opportunities in this thriving market.

The Evolution of Vehicle Manufacturing in Thailand

Various types of vehicles, including passenger cars and pickup trucks, dominate the production landscape, driven by favorable government tax policies and high consumer demand for multipurpose vehicles. Despite Ford being one of the earliest entrants into the Thai market, Toyota emerged as the market leader in 2022, capturing the largest share of vehicle production.

Automotive Product Trading: A Pillar of Thailand’s Economy

Thailand’s automotive industry significantly contributes to the country’s economic stability through extensive automotive product trading. The export value of automotive products has seen a substantial increase, reaching an impressive 18.9 billion Thai baht in 2022. The industry exports more than 3,000 types of vehicle components, with vehicle parts and accessories being major contributors to this growth. This expansion highlights the vital role of the automotive sector in Thailand’s overall economic framework.

Thailand as a Hub for International Automotive Manufacturing

The Thai automotive industry is a cornerstone of the nation’s economy, bolstered by a stable economic foundation and ample resources. Government policies have facilitated Thailand’s growth into a robust foreign original equipment manufacturer (OEM), particularly within the automotive sector. By 2023, Thailand had become the leading Southeast Asian country with the highest number of Japanese automotive manufacturing plants in Asia, underscoring its strategic importance in the region.

The Growth of Vehicle Production Capacity

Vehicle manufacturing in Thailand has evolved significantly since the 1960s when the government began importing automotives to support economic expansion. Initially focusing on vehicle parts, especially bodies and suspensions, Thailand has since expanded its production capacity. In 2023, the country produced 1.83 million units, with passenger cars comprising more than 637 thousand units. This growth reflects Thailand’s enhanced manufacturing capabilities and its strategic role in the global automotive industry.

Thailand’s Role in International Automotive Trading

The automotive industry is Thailand’s second-largest export sector, following the computer parts industry. The inflow and outflow of automotive products constitute a significant share of the country’s international trade. The roots of Thailand’s manufacturing industry trace back to the “Anglo-Thai Motor Company,” a joint venture between Ford of Britain and the Thai Motor Industry Co., which began by importing vehicle parts and performing local assembly for the domestic market. By 2022, vehicle parts and accessories led the export value of automotive products, reinforcing Thailand’s pivotal role in international automotive trade.

Key Players Driving Thailand’s Automotive Industry

Several international players drive Thailand’s automotive industry, with Japanese companies playing a prominent role. Despite the catastrophic flood in 2011, Japanese automotive companies continued to invest in Thailand, demonstrating confidence in the country’s economic attributes. Among these companies, Toyota stands out, accounting for around one-third of the market share of domestic car manufacturers. Toyota’s dominance is reflected in its status as the highest-selling car brand in Thailand in 2023, showcasing the brand’s enduring popularity among Thai consumers.

Conclusion

The period from 2012 to 2023 has been transformative for Thailand’s automotive industry, establishing it as a key player in Southeast Asia. The industry’s growth is driven by significant production volumes, robust international trade, and the presence of major global automotive brands. As Thailand continues to leverage its economic stability and government support, the future looks promising for the Thai automotive industry, with continued advancements and strategic developments on the horizon. Given this dynamic landscape, seeking expertise from Thailand Mobility Consulting is crucial for navigating the complexities and maximizing opportunities in this thriving market.