Thailand is rapidly emerging as a leader in digital payments, especially in Thailand QR Cross-border Payments. In 2024, 61.5% of the Thai population used QR codes via smartphones each month, making Thailand the third-highest QR code user in the world. This widespread domestic adoption has laid the groundwork for the country to take a pioneering role in cross-border payment systems across ASEAN.

Seamless Thailand QR Cross-border Payments Across Borders

The Bank of Thailand has partnered with Cambodia to launch a cross-border QR payment system that makes paying across borders simple and secure. Thai tourists and businesses can use their local bank apps (including Krungthai, Ayudhya, and Siam Commercial) to pay Cambodian merchants directly in Thai baht. Likewise, Cambodian visitors can easily pay in Thailand. The system allows up to 100,000 baht per transaction and 500,000 baht per day, giving users both flexibility and peace of mind.

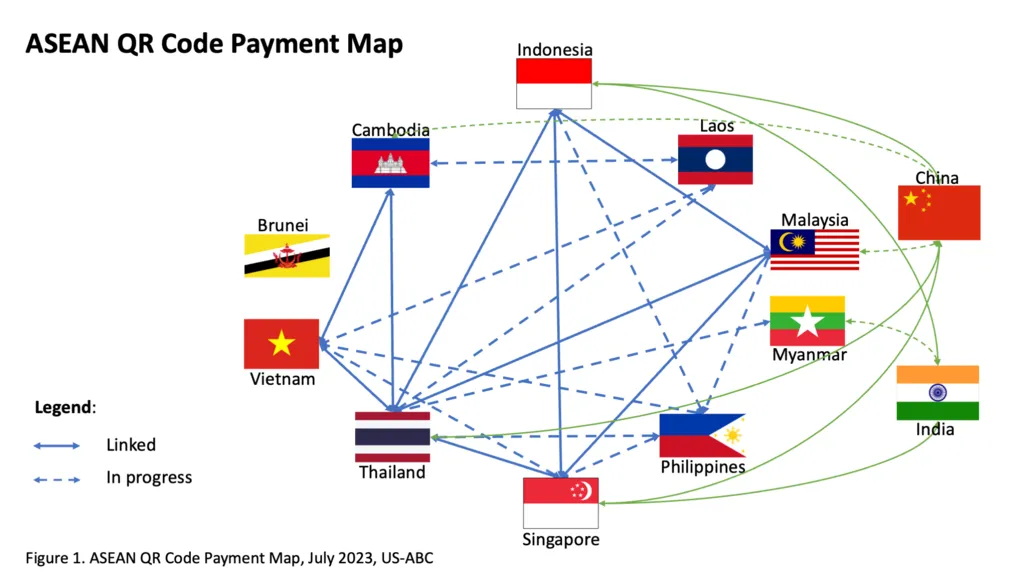

Beyond Cambodia, Thailand has expanded its QR payment linkages to other ASEAN countries, including Vietnam, Singapore, Malaysia, and Indonesia. These connections make it possible for people to make real-time, cost-effective payments using their mobile apps when traveling or doing business across the region.

A Regional Pioneer in Fintech

Thailand’s efforts go beyond simple convenience. The country is playing a key role in the ASEAN Payment Connectivity initiative, which aims to build a unified, inclusive digital payment system across member states. By connecting with Laos, Malaysia, Singapore, Indonesia, and Vietnam, Thailand supports a seamless financial ecosystem that benefits residents and tourists alike.

Major Thai banks such as Siam Commercial Bank, Krungthai Bank, and Bank of Ayudhya have been at the forefront of this push. These banks have not only strengthened regional QR payment networks but have also extended their reach beyond ASEAN, launching services in Japan and building new partnerships.

Read Also: Thailand Prepaid Wallet Expansion Powers Cashless Shift

Thailand QR Cross-border Payments: Strong Foundations with PromptPay

Thailand’s QR payment leadership is built on a strong foundation. In 2017, Thailand launched PromptPay, a mobile money transfer system using phone numbers or national IDs. Over time, PromptPay has expanded to support e-commerce and now plays a crucial role in Thailand QR Cross-border Payments.

This expansion supports the booming Southeast Asian digital payment market, which is projected to reach US$287.20 billion in transaction value in 2024. As more people across ASEAN adopt cashless transactions, Thailand's early investments in QR and mobile payment infrastructure give it a competitive advantage.

Read Also: When Thailand Fintech Adoption Rise Changes Things

Strengthening Regional and Global Ties

Thailand isn’t stopping at ASEAN. The Bank of Thailand is also working with China to create interoperable QR code payment systems. This move positions Thailand as a regional fintech hub, promoting greater financial inclusion and economic growth across Asia.

Through these partnerships, Thailand is not only making payments easier for its citizens and tourists but also driving innovation and setting new standards for digital financial services.

Connecting the Future Through Thailand QR Cross-border Payments

With its strategic vision and strong digital foundation, Thailand is helping shape the future of cashless payments in Southeast Asia and beyond. By championing Thailand QR Cross-border Payments, the country is creating an ecosystem that supports smoother travel, stronger business ties, and wider financial inclusion. In the years ahead, Thailand’s leadership in QR payment integration will continue to support economic growth and connect millions across borders, proving that technology can truly bring the region closer together.