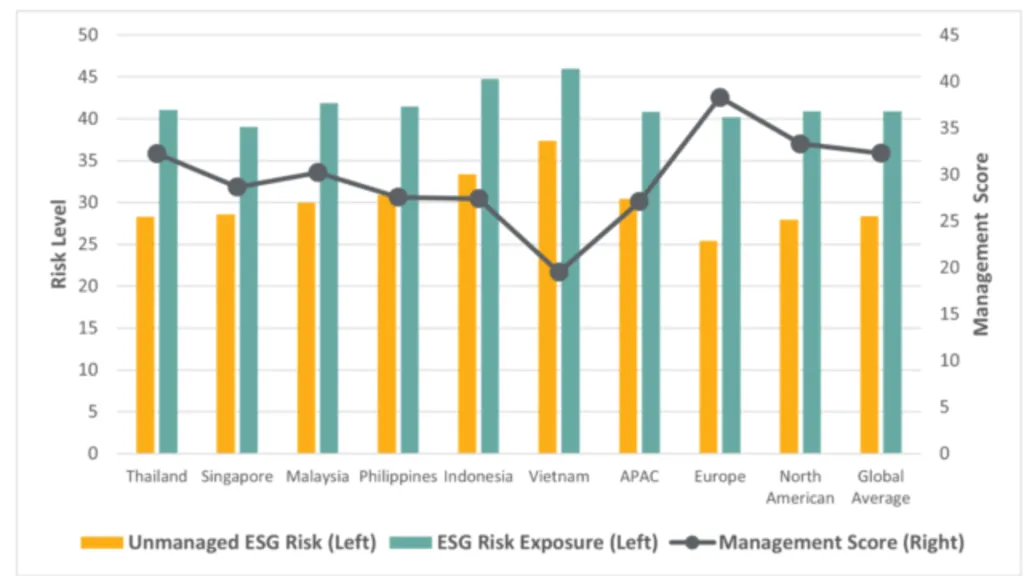

Thailand is under increasing pressure to raise its environmental, social, and governance (ESG) standards, especially from global buyers. As sustainability expectations rise, Thailand’s ESG pressure is mounting across all sectors, particularly in export-heavy industries like manufacturing, agriculture, and transport.

Today, 57% of Thai-listed companies publish ESG reports, a marked increase that shows growing awareness. Among Thailand’s largest firms, those with market capitalizations above THB 250 billion, the ESG disclosure rate jumps to 71%. Meanwhile, smaller companies lag at just 45%. In total, 224 companies have received SET ESG Ratings, covering 82% of the Thai stock market’s total value.

Carbon-Intensive Sectors Face Global Scrutiny

Thailand’s export-oriented economy is tightly tied to industries that emit large amounts of carbon. In 2023, the industrial sector released nearly 59 million tonnes of CO₂, making it one of the country’s biggest polluters. The transport sector, closely linked to exports and logistics, accounted for 31% of all energy-related emissions in 2022.

International regulators are now taking notice. Thailand ranked as the 13th largest exporter of carbon-related goods in 2023, shipping out $188 million worth of carbon-intensive products to countries like Japan, Vietnam, and the US.

This footprint has put Thai exporters directly in the crosshairs of new EU and US sustainability rules, which demand higher transparency and carbon accountability from suppliers.

Thailand’s ESG Pressure: EU and US Regulations Raise the Stakes

One of the most urgent developments is the EU’s Corporate Sustainability Due Diligence Directive (CSDDD). By 2026, Thai companies exporting to Europe must submit verified sustainability audits and traceability reports. The EU Deforestation Regulation (EUDR) further targets exports such as palm oil, rubber, and timber, or industries worth over $401 billion in 2022 EU import value.

These rules don’t just suggest action, but they require it. And the message is clear: if Thai exporters don’t align with these sustainability standards, they risk losing access to key global markets.

The BCG Model: Thailand’s ESG Pressure and Sustainable Strategy

In response, the Thai government has launched the Bio-Circular-Green (BCG) model. It is a national strategy to promote green innovation, sustainable agriculture, and lower emissions. One of its strongest incentives is a three-year tax holiday for companies that invest in green machinery or emissions-reduction technologies.

Support for low-methane rice farming, cleaner logistics, and traceability systems is also growing. New legislation and reporting frameworks are being rolled out to help Thai businesses comply with foreign ESG requirements while enhancing their competitive edge.

Read Also: The Sustainable Trends in Thailand’s Construction Industry

Turning Thailand’s ESG Pressure Into Opportunity

Thailand’s ESG pressure may seem intense, but it also opens the door to long-term growth. Proactive firms that align with the BCG model and adopt sustainability practices now are more likely to retain export contracts, attract foreign investment, and future-proof their operations. With nearly 60 million tonnes of industrial carbon emissions and mounting regulatory pressure from global trade partners, the path forward is clear. By choosing transparency, green innovation, and ESG commitment, Thailand can transform risk into opportunity and lead the region in sustainable export practices.

Read Also: Thailand Renewable Energy Policy Targets a Greener 2036