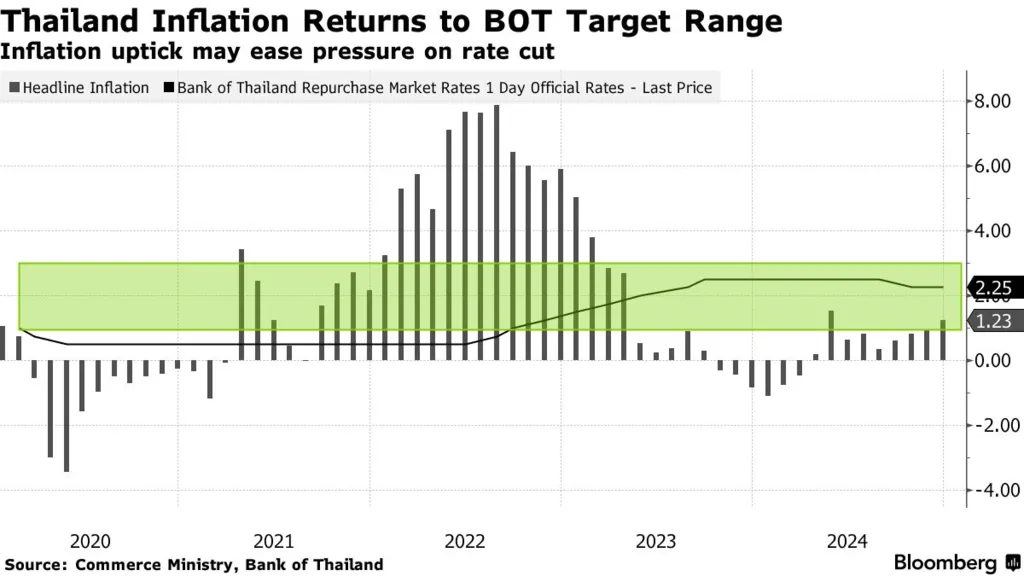

Thailand’s central bank is navigating one of its most complex challenges in recent years: falling inflation. Between January and July 2024, headline inflation averaged just 0.11%, well below the Bank of Thailand’s (BOT) target range of 1.0–3.0%. This sharp undershoot has forced policymakers to adjust their approach, marking a new chapter in the Thailand CBT Inflation Strategy.

A Rare Deflationary Phase

In 2025, the country recorded three straight months of negative inflation:

-

–0.22% in April

-

–0.57% in May

-

–0.25% in June

Falling energy prices and government subsidies were the main contributors. This unexpected deflationary trend has raised concerns about weak demand and prompted a policy shift.

Rate Cuts Signal a Shift in Thailand CBT Inflation Strategy

To combat these deflationary pressures, the BOT cut its policy interest rate by 25 basis points to 2.0% on April 30, 2025—its third cut since October 2024. The move highlights the central bank’s increased flexibility in managing both price stability and economic momentum. It’s a clear sign that the Thailand CBT Inflation Strategy is evolving to match shifting economic realities.

Read Also: Adaptive Moves in Response to Thailand Inflation & Policy Flexibility

Core Thailand CBT Inflation Strategy Remains Positive

Despite headline deflation, core inflation—which excludes volatile food and energy prices—stayed positive, hovering between 0.9% and 1.06%. This suggests that underlying demand remains intact, and the economy isn’t facing a deep, broad-based deflation spiral.

Sector-Specific Impacts of Deflation

While Thailand’s overall economy shows resilience, certain sectors are feeling the pinch of deflation more acutely. Agriculture, which accounts for 8-10% of GDP, saw prices for key exports like rice and rubber drop by 4-6% year-on-year in Q2 2025, squeezing farmer incomes. Meanwhile, the tourism sector—a critical growth driver—faced lower hotel rates and tour prices due to subdued demand, particularly from Chinese travelers.

However, not all industries are struggling. Consumer electronics and durable goods benefited from falling input costs, with smartphone and appliance prices declining 3-5%, boosting discretionary spending. The BOT’s rate cuts also provided relief to small and medium-sized enterprises (SMEs), lowering borrowing costs for businesses navigating the deflationary environment.

Read Also: Smart Moves Behind Thai Strategies for Tourism Recovery

Policy Framework Under Review

Recognizing the need for adaptability, Thai officials revised the 2025 inflation forecast to a range of 0.0%–1.0%, down from the original 1.0–3.0% target. This change reflects a growing acceptance that external factors—such as supply shocks and global trade slowdowns—require a more flexible inflation targeting framework.

The BOT has signaled it is open to future adjustments, including discussions around redefining inflation targets. The shift doesn’t mean abandoning the framework—it means modernizing it to handle short-term shocks without compromising long-term credibility.

Economic Growth and Thailand CBT Inflation Strategy Linked

Thailand’s GDP growth is projected at 2.3% in 2025 and 1.7% in 2026, with a target of 2.8–3% in coming years. The Thailand CBT Inflation Strategy aims to support these goals by ensuring that price movements do not disrupt consumer confidence or business planning. Rate cuts provide needed breathing room to stimulate spending and investment.

Balancing Stability with Flexibility

The BOT’s actions in 2025 reflect a pragmatic shift in central banking. While still committed to medium-term inflation control, the central bank is clearly willing to tolerate short-term deviations to prevent economic stagnation. This balance of credibility and responsiveness is becoming a defining feature of Thailand’s evolving monetary policy.