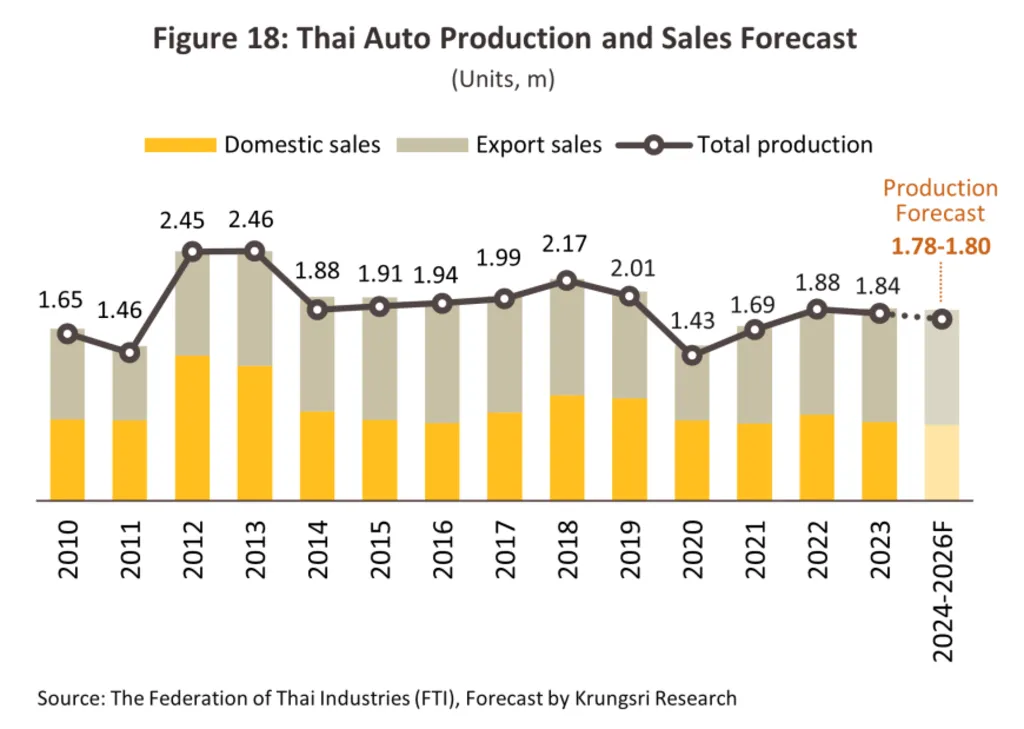

Thailand’s automotive market faced a difficult 2024. Local car sales dropped to 572,675 units, the lowest in 15 years, while car production declined 20%, falling to 1.47 million units. These figures reflect pressure from weak domestic demand and sluggish exports. Still, the Thailand automotive market recovery is beginning to take shape, driven by a bold focus on electric vehicles (EVs). In fact, 600,000 units in sales are expected for 2025.

Electric Vehicles Spark Thailand Automotive Market Recovery

Amid the downturn, one segment is booming: electric vehicles (EVs). In 2024, EVs made up 15.4% of total vehicle sales, showing strong momentum. Thailand’s EV fleet hit 233,699 units that year and is projected to grow to 1.1 million by the end of 2025. With a forecasted 40% growth in the EV market in 2025 alone, electrification is clearly leading the recovery.

Read Also: Thailand Automotive Industry Trends are Shifting to EV Dominance

The demand is not only seen locally. Thailand is now also supplying EVs to neighboring ASEAN markets like Indonesia and Vietnam to satisfy the export opportunities. Chinese automaker BYD has emerged as a key player, capturing 35% of Thailand's EV market share in 2024 through popular models like the Atto 3 and Dolphin.

Read Also: Export Power Fuels Thailand Manufacturing Resilience

Government Incentives Drive Demand

Thailand’s EV strategy is backed by comprehensive incentives running from 2024 to 2027. These include subsidies of up to 100,000 baht per EV and excise tax cuts from 8% to 2%. To qualify, automakers must commit to local production, a move designed to strengthen domestic manufacturing and build long-term capacity.

Moreover, the government has set a target for EVs to make up 30% of all cars produced annually by 2030. This goal reflects a wider ambition to position Thailand as Southeast Asia’s EV leader. It’s a strategic pivot that aligns with global shifts toward cleaner transportation and lower carbon emissions.

Foreign Investment Fuels Thailand Automotive Market Recovery and Growth

Thailand’s EV ambitions are attracting significant foreign investment. Chinese automakers have already committed over $1.4 billion to the sector, encouraged by the generous subsidies and tax relief. These companies are not only producing vehicles but also reshaping Thailand’s role in the global auto supply chain.

Production to Rebound by 2028

Despite the current slowdown, the long-term outlook is positive. By 2028, vehicle production is projected to reach 2.98 million units, with an annual growth rate of 2.5%. EVs are expected to account for a growing share of this total, further transforming the makeup of Thailand’s auto sector.

This recovery will be supported by new battery production facilities, including a $1 billion plant being built by China’s Gotion High-Tech in eastern Thailand. The government’s Eastern Economic Corridor (EEC) initiative is proving particularly attractive to investors, offering additional tax holidays and streamlined regulations for EV manufacturers. As traditional automakers like Toyota and Honda retool their Thai factories for electric models, the country is positioning itself as both a production hub and the innovation center for next-generation mobility solutions.

Thailand’s New Automotive Identity

This shift is more than a temporary fix—it’s a reinvention of Thailand’s automotive identity. As traditional vehicle sales recover and EVs gain traction, Thailand automotive market recovery is being shaped by innovation, policy, and global demand for sustainable transport.

Thailand Automotive Market Recovery Powered by Innovation

Thailand’s auto industry may have hit a low in 2024, but it’s poised for a strong comeback thanks largely to its focus on EVs. With smart policies, strong investment, and a clear vision for the future, the country is not just recovering. It’s redefining its place in the global automotive market.