Thailand’s e-commerce industry is facing major changes. As new Thailand E-commerce Tax Reforms take effect, online sellers are under more pressure to comply or risk penalties. Analysts predict that these shifts could lead to a 10% drop in active online shops, as some vendors close to avoid income disclosure and VAT obligations.

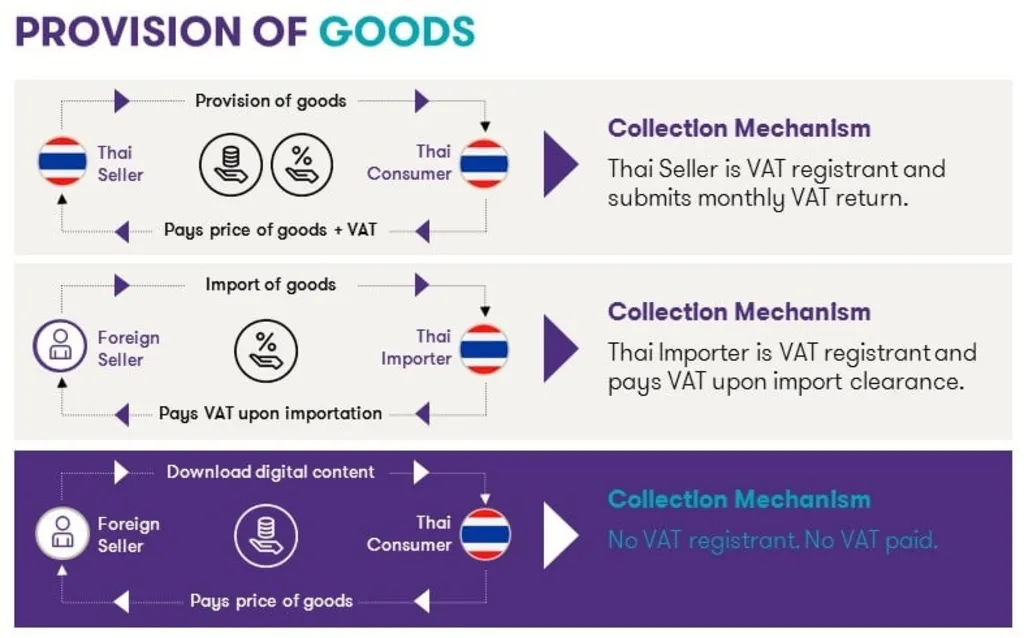

At the heart of these changes are updated Value Added Tax (VAT) policies and stricter reporting rules. Together, they aim to create fairer competition, especially for local small and medium-sized enterprises (SMEs) who’ve long faced uneven ground against foreign sellers and under-the-radar competitors.

Thailand E-commerce Tax Reforms: Key Measures

One of the most impactful updates is the removal of the VAT exemption for low-value imports under 1,500 baht, effective July 5. Previously, this loophole allowed foreign sellers, especially from China, to avoid taxes that local businesses couldn’t escape. Now, both local and imported goods are taxed equally, offering better protection for Thai SMEs.

Another major reform targets digital platforms and foreign service providers. Any foreign e-service platform earning more than 1.8 million baht annually from Thai users must now register for VAT under the VES (Value Added Tax on Electronic Services) system. This move ensures that overseas platforms pay taxes like local businesses do.

Local online platforms must also disclose more information. Platforms earning over 1 billion baht annually must report vendor income data to the Revenue Department within 150 days of their fiscal year-end. This helps tax authorities track individual vendor earnings, making it harder to hide income.

Vendor Obligations and Thresholds

Individual online sellers are not exempt from the pressure. If they earn more than 60,000 baht a year, they must file taxes twice annually. This happens once midyear and again at year-end. If their annual revenue exceeds 1.8 million baht, they must register for VAT within 30 days. The threshold is critical. Cross it, and you’re in full compliance territory with more reporting and tax filing duties.

Challenges for Businesses? See Thailand E-commerce Tax Reforms

While the reforms aim to level the playing field, they also introduce new challenges. Many vendors lack awareness of the rules or struggle with administrative complexity. Detecting and verifying online transactions, especially for small or cash-based sellers, remains difficult for tax authorities.

There’s also concern about price increases. As compliance costs rise and vendors factor in VAT, consumers may see higher prices at checkout. Still, the reforms promise long-term benefits, especially for SMEs who now face fairer competition.

Read Also: Thailand Consumer Simplicity Preference Shift in Action

Compliance Strategies for Sellers

To navigate these reforms, sellers should focus on clear and consistent record-keeping. Prepare tax forms like P.N.D.94 and P.N.D.90 for individuals or P.N.D.51 and P.N.D.50 for companies. Monitor your revenue carefully, especially if you’re near the 1.8 million baht VAT threshold.

Use accounting software or hire tax professionals to stay on top of filing deadlines. And stay informed, since regulations may continue to evolve as Thailand’s digital economy matures.

Read Also: Thailand Digital Wallet Scheme Initiative: Economic Impacts

Thailand E-commerce Tax Reforms in Summary

Thailand E-commerce Tax Reforms are transforming how online sellers do business. While the rules bring growing pains, they also signal a shift toward a more transparent and equitable digital economy. For sellers who adapt early, these changes offer not just compliance but a competitive edge.