Thailand’s real estate sector is witnessing significant changes driven by post-pandemic recovery, rising foreign investments, and emerging market preferences. There are three key Thailand Real Estate Trends are shaping the industry that will be covered in this article. Let’s explore these in more detail below!

Residential Thailand Real Estate Trends: A Recovery in Progress

The residential real estate market in Thailand is poised for steady growth. In 2024, the market size is estimated at USD 154.51 billion and is expected to reach USD 202.33 billion by 2029. This translates to a compound annual growth rate (CAGR) of 5.54% over the forecast period. However, the path to recovery hasn’t been smooth.

The COVID-19 pandemic dealt a severe blow to Thailand’s real estate market. After an expected recovery in 2021, the rise of new virus variants caused a slower rebound than anticipated. Yet, by 2022, the government introduced several key measures to support the market. One notable step was the Bank of Thailand’s extension of the loan-to-value (LTV) ratio, allowing homebuyers to borrow up to 100% of the property value. This policy aimed to stimulate demand, support employment, and revitalize the supply chain disrupted by the pandemic.

Bangkok and Vicinities: A Hub for Residential Growth

Bangkok and its surrounding areas are a focal point of Thailand Real Estate Trends and market expansion. Even during the pandemic, this region saw increased development activity. Affordable housing options for the middle to upper-middle class have driven growth, aided by the expansion of the Bangkok Mass Transit System (BRT) and Mass Rapid Transit (MRT) systems.

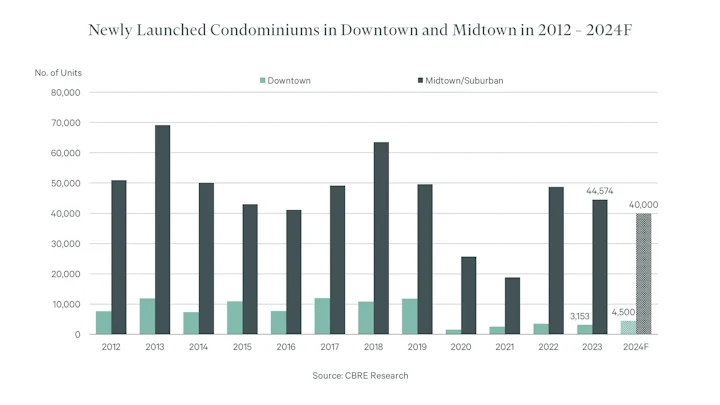

In 2021, Bangkok accounted for over 96,000 registered housing units and saw more than 43,000 new housing launches. Condominiums dominated the transactions, with detached houses and townhouses following closely behind. Investments in infrastructure and government stimulus measures are expected to continue bolstering the Thailand Real Estate Trends. Foreign buyers, particularly from China, are also playing a crucial role. In fact, foreigners hold over 60% of condo transfers in Bangkok, one of the Thailand Real Estate Trends that underscores the growing international interest in Thai property.

The Rise of Mixed-Use Developments

As the commercial real estate sector recovers, there is a rising demand for mixed-use developments. These projects, which combine residential, office, and retail spaces, cater to changing lifestyle preferences. The focus on urban living and the integration of work and leisure spaces have increased the appeal of such developments, particularly in urban hubs like Bangkok.

The recovery in Thailand’s tourism sector, following relaxed COVID-19 border restrictions, also adds to the growth of the commercial Thailand Real Estate Trends. In 2022, international tourism arrivals surged, with 11.15 million visitors, and the upward trend continues. The real estate sector benefits from this rise, particularly in regions like Phuket, where foreign buyers are increasingly investing in luxury properties.

High-End Residential Properties: Thailand Real Estate Trends

In 2024, Thailand’s high-end residential sector will be a key driver of real estate growth. Developers are focusing on luxury condominiums and high-end housing in central Bangkok. While fewer low-rise housing projects are expected, the market for properties priced between THB 15–30 million remains robust.

Thailand Real Estate Trends show that the real estate market is on a recovery path. This is fueled by strategic government measures, rising foreign investments, and a growing demand for high-end and mixed-use developments. As the tourism sector continues to rebound and infrastructure projects advance, the market is poised for steady growth in the coming years.