Infrastructure investment plays a critical role in Thailand’s economic growth. Over the past decade, the Thai government has poured almost THB 4,000 billion into enhancing the country’s infrastructure. However, despite these efforts, an infrastructure gap remains. Recent estimates suggest that if the current Thailand Infrastructure Investment trends continue, Thailand could face a USD 100 billion shortfall in infrastructure spending by 2040. Nonetheless, the government is taking steps to address this gap through large-scale projects, with a focus on public-private partnerships (PPPs).

The Role of Public-Private Partnerships

To tackle the gap in Thailand Infrastructure Investment, the Thai government has increasingly turned to PPPs. Over the past 20 years, infrastructure projects in Thailand under PPPs have seen investments of approximately USD 28 billion. PPPs offer a solution to public finance constraints by allowing private sector involvement in critical projects. This approach not only facilitates project financing but also helps distribute risk between the government and private investors, making the projects more feasible.

Thailand has seen notable success in this regard, particularly in the Eastern Economic Corridor (EEC). The EEC flagship projects include the development of Thailand’s first high-speed rail, linking three airports, and the expansion of U-Tapao International Airport. These projects, with a combined investment of over THB 600 billion, represent significant steps toward improving the country’s transportation infrastructure. As of December 2020, three of the six flagship projects in the EEC have secured PPP agreements, and they are expected to commence operations by 2024 or 2025.

Challenges in Financing Thailand Infrastructure Investment

Despite these successes, Thailand faces significant challenges in securing funding for Thailand Infrastructure Investment projects. The country’s economy grew by only 1.9% in 2023, far below expectations. This has put additional pressure on public finances. Especially as the government introduces schemes like the THB 500 billion (USD 13.6 billion) Digital Wallet. This is intended as a way to stimulate private demand.

Private sector financing, particularly from Thai banks, is also constrained. International banking regulations, like Basel III and IV, have raised capital and liquidity requirements. As a result, this is making infrastructure projects less attractive to banks due to their high-risk nature. Furthermore, structuring PPPs to balance the interests of both the public and private sectors is challenging. Investors seek profitable returns, while the government aims to address societal needs at an affordable cost.

New Approaches to Thailand Infrastructure Investment

Given these Thailand Infrastructure Investment constraints, the country needs to explore new financing mechanisms. One potential solution is the establishment of a National Infrastructure Bank (NIB), a model successfully implemented in countries like China and Indonesia. NIBs provide long-term loans and credit enhancements for priority sectors, helping to close the funding gap for large-scale infrastructure projects.

These new financial structures could play a key role in ensuring that Thailand continues to invest in its infrastructure. If the country can bridge the Thailand Infrastructure Investment gap, the long-term benefits to the economy will be significant. This includes improved transportation networks to enhanced energy infrastructure, making the country more competitive on the global stage.

Future Outlook: Construction Boom

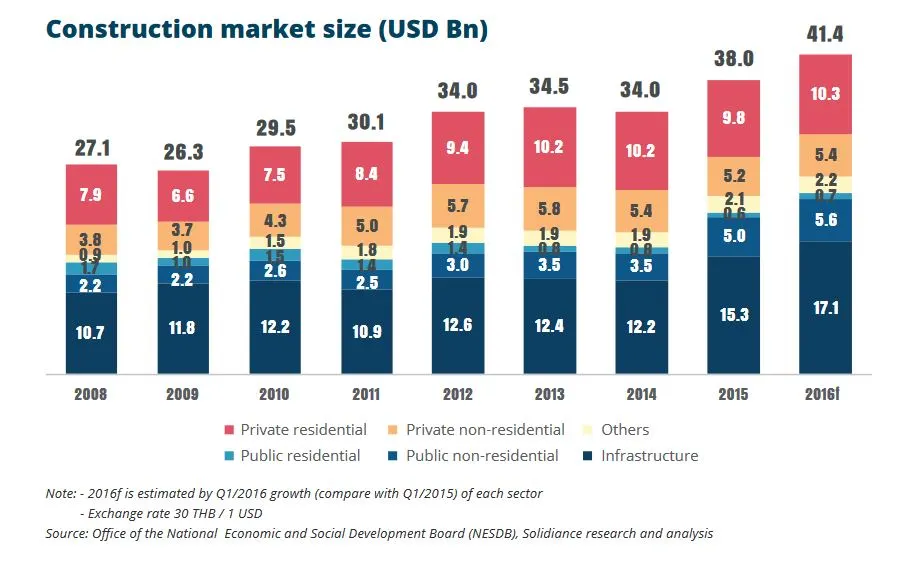

The construction industry in Thailand is expected to grow by 4.6% in 2024, with an average growth rate of 3.2% from 2024 to 2033. This growth is driven by ongoing infrastructure projects, particularly in rail and non-residential buildings. There are risks such as slowing foreign direct investment (FDI) from Mainland China and Thailand Infrastructure Investment difficulties. Major construction companies might be heavily impacted by this, but the overall outlook remains positive.

Thailand’s commitment to large-scale infrastructure development, especially in the EEC, will likely fuel this construction boom. New projects in the transportation sector, such as high-speed rail and airport expansions, are expected to improve connectivity and stimulate further economic growth. Additionally, energy infrastructure projects, like new power plants and grid upgrades, will be crucial in supporting Thailand’s industrial growth.

In conclusion, Thailand Infrastructure Investment, particularly through PPPs, is setting the stage for a construction boom that will drive economic growth in the coming years. Despite challenges in financing, the government’s commitment to improving transportation and energy infrastructure will ensure long-term benefits for the Thai economy.