Thailand’s construction industry faces mounting financial hurdles. From high construction costs to limited funding, these challenges threaten the growth and sustainability of large-scale projects. Let’s dive deeper into Thailand Construction Financing Challenges in this article, where we will examine common financing issues and explores potential solutions to support the sector’s development.

Thailand Construction Financing Challenges: Declining Market Confidence

The construction market in Thailand is projected to decline by 2.4% in real terms in 2024. High interest rates and rising construction costs have weakened both investor and consumer confidence. These factors are creating a challenging financial environment, reducing the profitability of new projects.

Additionally, the industry is expected to grow by only 2% year-on-year, further highlighting its struggle against financial volatility. With public debt projected to reach 68.6% of GDP by 2028, government spending on infrastructure may also decrease, intensifying funding challenges for construction firms.

Financing Obstacles and Market Inefficiencies

One of the primary Thailand Construction Financing Challenges facing the construction sector is uncollateralized lending, which accounts for 44% of GDP. This practice increases risks for both lenders and borrowers, making it harder for construction companies to secure reliable financing.

Labor shortages further complicate the issue. Skilled workers are in high demand but short supply, with labor accounting for approximately 20% of total construction costs. This imbalance reduces productivity and increases operational expenses.

Delayed government budgets exacerbate these problems. In early FY24, only 0.04% of GDP was allocated to capital projects due to late budget approvals. This delay has significantly reduced funding availability for essential infrastructure developments.

Thailand Construction Financing Challenges: Delays and Rising Costs

Poor contractor management and planning deficiencies are major contributors to project delays. Such inefficiencies lead to cost overruns, creating additional financial strain on developers. Without effective solutions, these recurring problems threaten the viability of large-scale construction projects.

However, initiatives like CoST (Construction Sector Transparency Initiative) demonstrate that improved management practices can yield significant savings. CoST has shown potential savings of THB 11.5 billion (USD $360 million) by enhancing transparency in construction projects. This approach highlights the importance of accountability in mitigating financial risks.

Solutions to Thailand Construction Financing Challenges

Several strategies can address these financing obstacles and support the construction industry’s recovery.

1. Public-Private Partnerships (PPPs):

PPPs offer a viable solution for funding large-scale projects. By sharing investment costs and risks between public and private entities, PPPs make projects more feasible. This model also leverages private sector expertise to improve efficiency and project outcomes.

2. Infrastructure Investments:

The Asian Development Bank’s $180 million investment in urban infrastructure demonstrates how targeted funding can enhance project viability. Improved infrastructure attracts private investment and supports sustainable growth in secondary cities, reducing pressure on urban centers.

3. Government Reforms for Thailand Construction Financing Challenges:

The establishment of a Technical Working Group by the Ministry of Economy and Finance aims to streamline project approvals and monitor implementation. These efforts promote greater coordination and ensure funding is directed toward high-priority projects.

The Road Ahead for Thailand Construction Financing Challenges

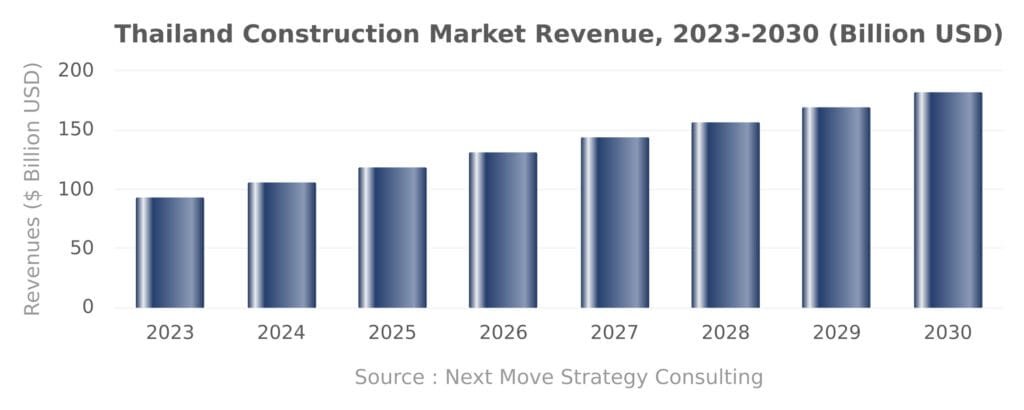

Despite the challenges, Thailand’s construction industry has opportunities for recovery. With a projected market growth of 2.86% from 2025 to 2029, the sector is poised for gradual improvement. However, success depends on addressing key financing issues, such as high costs, labor shortages, and delayed funding.

By implementing solutions like PPPs, promoting transparency, and investing in infrastructure, Thailand can build a more resilient construction sector. These efforts will not only enhance financial stability but also ensure the timely completion of critical projects.

The country’s construction industry faces significant Thailand Construction Financing Challenges. However, solutions are within reach. Public and private sector collaboration, improved transparency, and targeted infrastructure investments are essential to overcoming these obstacles. By addressing these issues, Thailand can create a more sustainable and efficient construction landscape, ensuring long-term growth for the industry.